The We Are Social 2025 report offers more than a set of statistics on Türkiye’s digital ecosystem. It provides a comprehensive view of user behavior, device preferences, social media habits, and digital consumption trends, delivering valuable insights for digital marketing, e-commerce, and brand strategy.

Below is a structured analysis of the key findings and their strategic implications.

Population and Demographic Structure

- Türkiye’s population has reached 87.6 million.

- Average age: 33.5

- Largest age group: 25–29 years, with approximately 6.9 million people

- The second most populated group is ages 10–14.

These figures confirm that Türkiye has a young, digitally native population that is highly integrated into online environments.

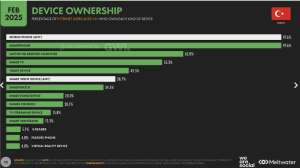

Device Usage and Internet Access

Among individuals aged 16 and over:

- 97.6% use a mobile phone (almost entirely smartphones)

- 62.8% use a computer

- 55.3% use smart TVs

- 43.5% use tablets

When it comes to internet access:

- 98.8% access the internet via mobile phones

- 96% of these users are active on social media

This highlights the central role of mobile devices in Türkiye’s digital behavior.

Average Daily Internet Usage

Daily internet usage by device:

- Total average: 7 hours 13 minutes

- Mobile phone: 4 hours 4 minutes

- Smart TV / connected TV: 3 hours 33 minutes

These figures clearly position mobile as the core of digital life in Türkiye.

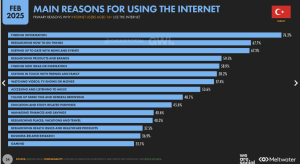

Primary Reasons for Internet Use

Among users aged 16 and above, the main motivations for using the internet are:

- 76.2% to search for information

- 67.7% for “how-to” content

- 67.3% to follow news and current events

- 59.5% to research brands or products

- 57.4% to watch movies or videos

This ranking shows that users rely on the internet not only for entertainment, but also for learning, problem-solving, and purchase decision support. The high percentage of brand and product research once again underlines the importance of digital marketing visibility.

Browser and Platform Preferences

- Chrome is the most widely used browser, followed by Safari.

Most frequently visited platforms and services:

- Social networks: 97.8%

- Messaging / chat apps: 97.2%

- News portals: 93%

- Email services: 90.2%

- Online shopping platforms: 62.4%

- Food delivery services: 58.2%

- Entertainment platforms: 46.4%

These figures indicate that digital consumption in Türkiye is heavily driven by social, visual, and interactive platforms.

Social Media Usage and Demographics

According to the report:

- Active social media users: 58.5 million (66.7% of the population)

- Users aged 18+: 55.9 million, with a penetration rate of 85.5%

- Gender distribution:

- 46.6% female

- 53.4% male

While gender ratios vary by platform, the overall trend shows slightly higher activity among male users.

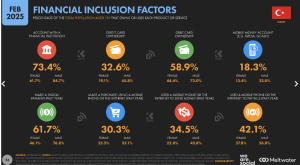

Financial Access and Digital Payment Behavior

The We Are Social 2025 data reveals that digitalization in Türkiye extends far beyond content consumption and social media.

- 73.4% of individuals aged 15+ actively use a financial institution account

- Among men, this rate rises to 84.7%

In addition:

- 61.7% of users made at least one digital payment in the past year

- Online money transfers (45.8%) and bill payments (56.0%) are particularly common among male users

These insights highlight a strong foundation for digital banking, fintech solutions, and online financial services.

Online Shopping Behavior and E-Commerce Trends

- 61% of internet users shop online every week

- 37.4% purchase groceries online

- 40.6% actively use price comparison tools

- 9.6% participate in second-hand online shopping

- “Buy now, pay later” models currently stand at 8.5%, but show growth potential

These trends confirm that e-commerce has surpassed traditional shopping habits. Brands must focus on competitive pricing, seamless user experience, trust, and visibility to remain competitive.

Strategic Insights and Key Recommendations

Mobile-First Is No Longer Optional

With 61% of users shopping online weekly, mobile-optimized e-commerce infrastructure, fast-loading pages, smooth checkout flows, and mobile payment convenience are critical success factors.

Video and Visual-Driven Content

More than 7 hours of daily internet usage—much of it spent on social media and video—creates significant opportunities for short-form video, visual storytelling, and interactive content.

Information-Led Content Strategy

- 76.2% use the internet to find information

- 59.5% research products and brands before purchasing

This means brands should invest beyond product listings, focusing on blogs, how-to guides, comparison content, reviews, and educational videos that support the purchase journey.

Social Media Management as a Competitive Advantage

With 58.5 million social media users, a consistent, inclusive, and data-driven social media strategy is essential for digital visibility in Türkiye.

Conversion-Focused and Interactive Content

Given high engagement across portals, email, shopping, and food platforms, brands should use rich content formats such as product storytelling, tutorial videos, and interactive campaigns to drive conversions.

Final Evaluation

The We Are Social 2025 report clearly shows that Türkiye continues to advance both quantitatively and qualitatively in digital adoption. A young population, mobile-first behavior, and high social media engagement create substantial opportunities for individuals and organizations that invest strategically in digital channels.

For brands and marketers, success lies in mobile optimization, content depth, data-driven decision-making, and integrated digital strategies aligned with evolving user expectations.